Whooph Trades —— Market’s Map

What precedes every swing or reversal?

Whooph shares 2 of his trades per week, bearing actionable swing trade METHODS for consistent income, and lock-it-in-NOW capital preservation tips for investors.

I hope you’ll stay and catch the secrets I’m about to share. And hold them dear! These Methods which I’m divulging in the Natural Gas ETF (BOIL) can be used in any equity or crypto swing or trend trade. By the way, information like this is rarely doled out FREE.

Fabulous platform; thank you Substack!

BOIL (-1.6%) 2X Natural Gas ETF:

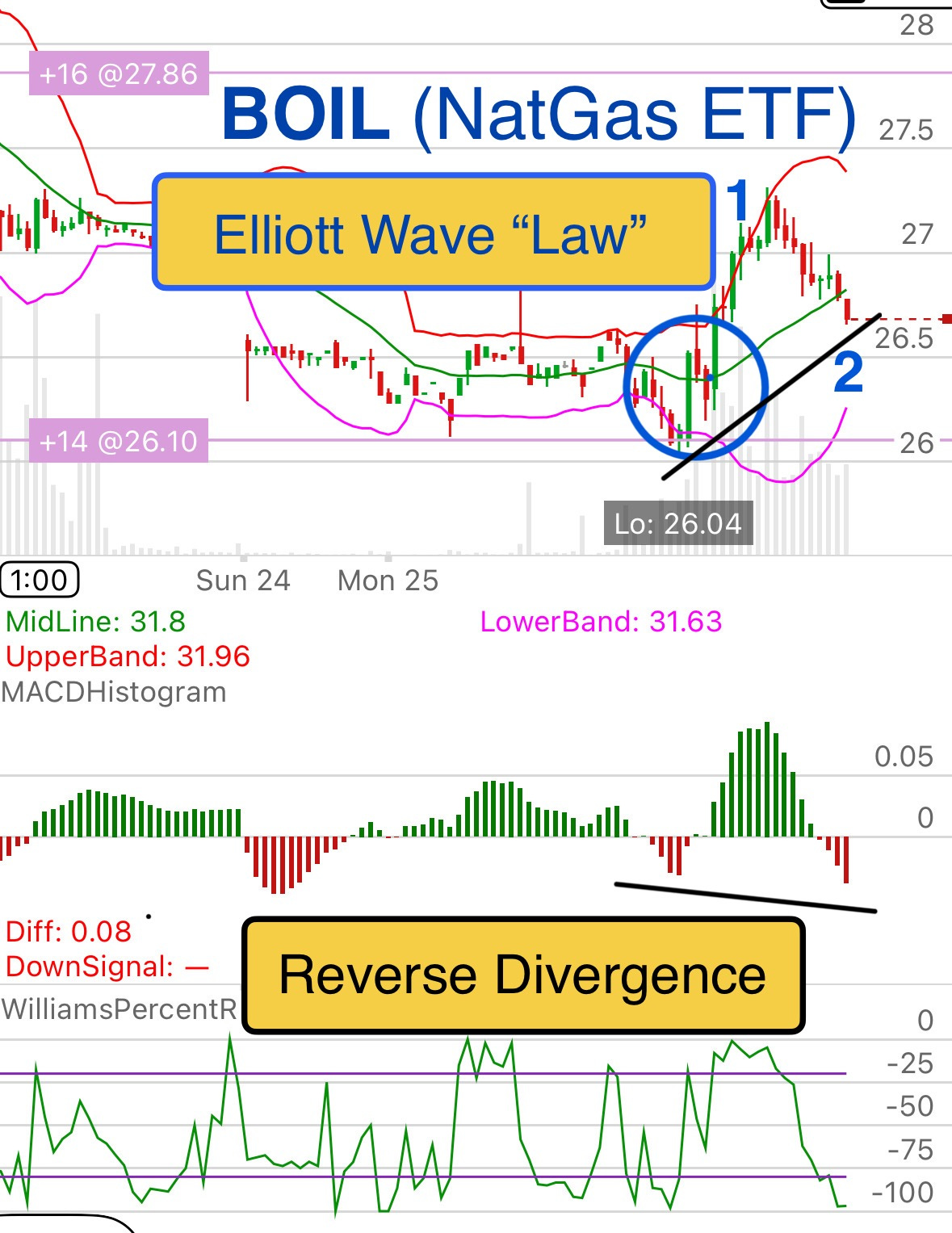

Well the 10-Day 15-min chart (below) looks good for bulls. Note price has crossed above the 20-period moving average, a trigger to BUY. Which I did @ 26.4

And there’s a nice pull-back, if you’re interested. This would be Elliott Wave 2 of a 5-Wave uptrend. One key to savvy trading is know where you are!

A Market’s Map

Understanding that markets move in discernible WAVES is a license to map them, anticipate them, and profit from them. Yes, I said “map”. I said it about Oil which led us down in 2020. WTI Oil in fact, tipped her hand an entire THREE WEEKS before the broad market COVID crash. It pays to heed commodities when broad markets are showing weakness.

Look, I didn’t make consistent income until I embraced the fact that markets move consistently in Elliott Wave patterns. How you parse them? Is not via Price - that’ll give you a headache. Nevertheless, WAVES are painfully real for those who dismiss them or reject their order in markets.

Elliott Wave order exists in 99% of all trends in every timeframe.

Call it Human Psychology for trade decisions in Large Numbers that causes the Wave phenomena. I don’t know. And best of luck disproving Elliott Wave! I’ve analyzed 40,000 charts in 25 years trading daily and I failed to disprove the theory. So, call it Law.

Knowing Waves 1-5 are inevitable in any primary trend in any timeframe, you are hereby licensed to profit from them.

So, the Wave 2 pull-back below happened as anticipated. We waited for it and bought it. Nice profit because a good swing trader knows Elliott Wave Theory (Law).

Reverse Divergence (BULLISH)

Notice also the red MACD low at point 2 is lower than the prior MACD low, while Price hung higher. This is bullish disagreement between Price and the MACD. Also known a Reverse Divergence. We’ll be teaching this very important “tell” soon in another post.

So, now we’re at Wave 2 of 5, assuming this has legs more than just a 3-Wave corrective “bounce”.

Whooph has studied and swing-traded predictive tells since he began in 1999.

George Lane’s Stochastic

Analysts insisted and reiterated that market price used in calculating your Stochastic oscillator are derived from historical data!

George Lane explained for the agitated analysts the assertion why his Stochastic oscillator issues signals which can foretell market movements:

Price has momentum.

Stochastic does not.

Lane turned and walked out, leaving them flummoxed. No one dared to ask him again.

Whooph averages 121% annually TWA.

Being Able to Relax in Your Buy

The benefit of recognizing Price and MACD in a Reverse Divergence in the 4-hour and Daily charts (not shown) is that you can “relax a bit” owning Oil here. There’s always some anxiety in taking a market position. But understanding Wave 2 and now this Price-Indicator Divergence concept, you can feel confidence, not Adrenalin.

Note: This is seller weakness goes by several names, my favorite is my invention: Price-Indicator (MACD) Disagreement. And here it’s bullish!

Final Notes: A Little Background

Big Boy commodity shorts have scoffed at the seller weakness for 2 months now as NatGas Production (107 bf) remains a hair high, and they’ve sought lower prices for inevitable periodic spikes.

How low is low enough for those Big Money traders, before they let BOIL rise or allow a customary 30% spike? Customary in August or September. Your guess is as good as mine. IMO, it’s tightly wound spring!

I’m LONG this jewel as per my Whooph Methods.

I’m Charlie Whooph. I share my own positions, 2 trades per week here at Whooph.Substack. I’ve been swing trading since 1999 for consistent income to the tune of 1.7% per day (2-year average).

I’m happy to answer any question on trader or investor METHODS. And, If I don’t know, I’ll say so. And perhaps I could steer you to great publications, which I enjoy right here on Substack.

— Charlie Whooph, CFE

Thank you so much for reading.

Disclaimer:

This content is for educational, informational, and entertainment purposes only. Nothing herein should be considered as investment, business, legal, or financial advice pertaining to your specific situation, goals, needs, or risk tolerance. Ideas published by me or Whooph LLC on Whooph.com, Charlie Whooph.Substack, or Whooph Trades Publication on Substack are derived from my own experience and opinions. Please do your own due diligence, conduct your own research, and consult a licensed or certified professional before making decisions on life or legal matters, taxes, financial, investment, or health needs.

Thanks a million, James!