Whooph Trades - Citing Tops and Bottoms

Where does Charlie Whooph Begin Looking for reliable Indicators of a Top or Bottom?

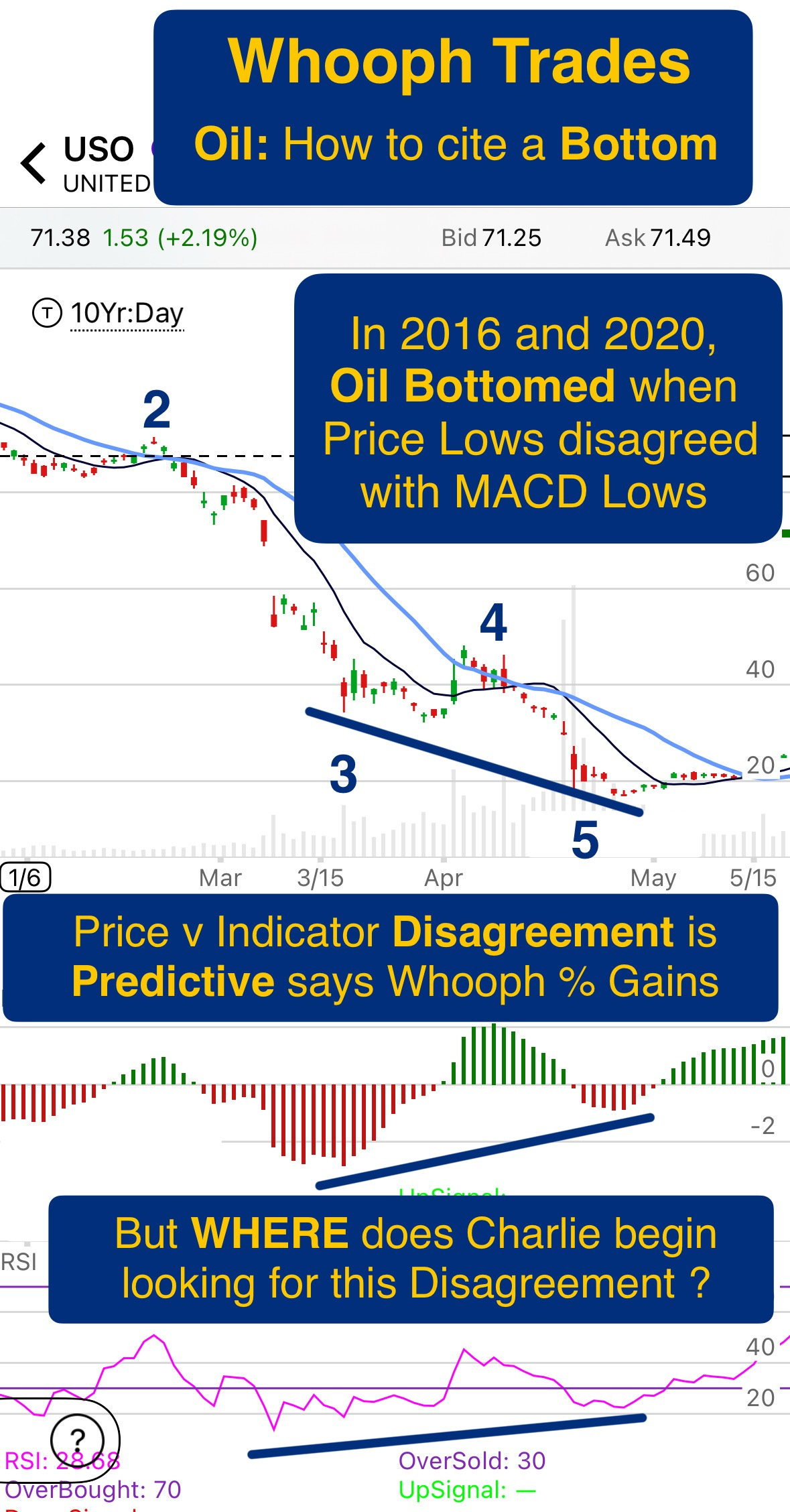

Whooph’s consistent gains are largely determined in the process of citing swing bottoms and swing tops on any timeframe. Whether an investor or a trader.

Charlie Whooph says a Market “tells” on itself before its inks a Top or Bottom. And there is a specific time and place within the structure of a market trend or consolidation to look for and cite that tell.

GEORGE LANE

Seasoned commodities trader George Lane, invented one of the first and most popular oscillating indicators in the late 1950s.

When pressed by his commodities trader team, Lane made an historic statement explaining how an Indicator v. measured Price when used correctly is predictive. He tersely remarked:

Price has MOMENTUM.

Indicators DO NOT.

He walked out of the room. His fellows were dumbfounded. “This is significant”, said one fellow commodities trader. “No, this is genius,” said another, realizing the team might possibly cut in HALF the amount of time they spent researching and crunching data for swing trades in commodities futures.

Lane’s understanding of a thing measured such as Price versus an Indicator’s data measurement such as Stochastic or MACD was ground-breaking. Properly read, he would be able to predict Bottoms and Tops before they formed.

Frustrated unskilled critics vehemently claimed then as they do today that historical data cannot be used to foretell anything! (Whooph chuckles.)

TRADERS TODAY

Lane’s understanding of Price-Indicator uptrending highs v. downtrending lows was unmatched at that time and ironically has gone lost on investors and swing traders today.

For lack of teaching on the relationship between measured v measurement, Price v Indicator, Traders are forever floundering amid ill-timed or utterly false assertions of an equity’s supposed “over-bought” or “over-sold” condition and other similar false signals.

Flummoxed by their own methods’ failure to issue reliable signals to buy or sell, market’s “stubborn persistence” bears the fault.

Way too many indicators today, with too little understanding of how to effectively use them in an entry or exit, or how they can foretell market movements, swings, corrections, and reversals. And do, for any equity, in any timeframe!

George Lane’s incisive truth:

“Price has Momentum; Indicators DO NOT.”

lays incredulously dormant, scarcely known but to a few, buried in some archived unsearchable document, or in some dossier on a dusty shelf, and here in Charlie’s Whooph.substack.com

Whooph trades Lane’s methods everyday.

Subscribe FREE to Charlie Whooph, read his brief explanations in Whooph Trades and other posts, and learn the skill.

Charlie has been swing trading since 1999, and as of today averages 155% annually TWA. “FREE” because Whooph’s income is derived from trade gains, not subscriptions.

Thank you so much for reading! - Whooph