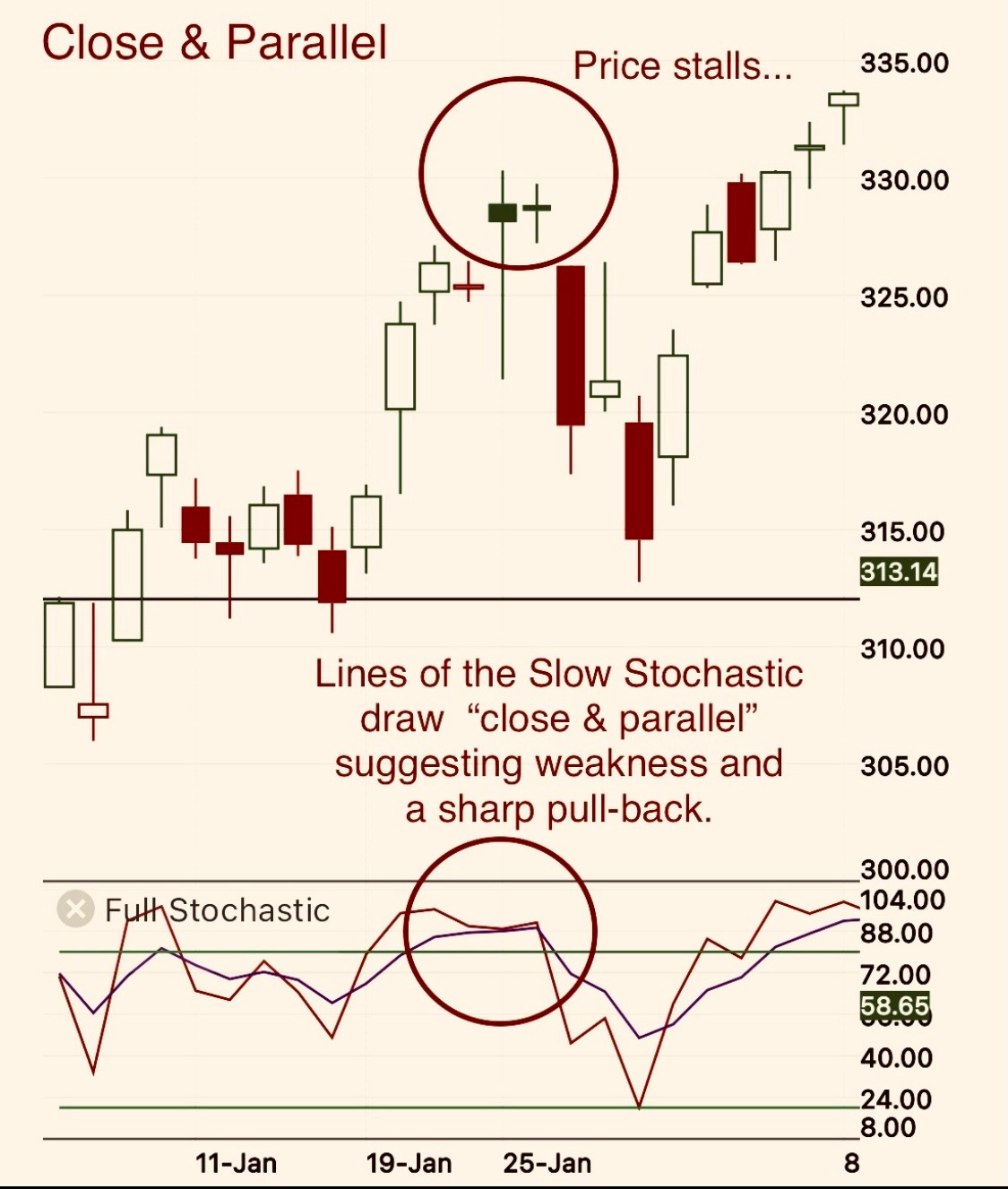

Close n Parallel

Foretelling a Price Reversal

Can George Lane’s Stochastic Oscillator foreshadow swings or reversals before price knows it?

Dr. Lane was a smart guy to recognize a predictive nature of his measurement, naturally complimented by a market’s psychology of Traders in Large Numbers.

THE FORMULA

for the Stochastic Oscillator:

%K = (C−L14) / (H14−L14) × 100 where: